If you’re an entrepreneur, you understand the importance of funding. Have you heard of PMEGP Scheme or the Prime Minister Employment Generation Programme? Do you know how to apply for a PMEGP loan, which is the PMEGP portal or PMEGP online application?

Are you eligible for a PMEGP loan and what how much loan can you get? Read on to find the answers you seek.

| Issuer | Ministry of Micro, Small and Medium Enterprises |

| Who is eligible | 1. Individuals above 18 years old 2. Self Help Groups 3. Institutions 4. Charitable Trusts 5. Co-operative Societies |

| Repayment tenure | 3 to 7 years |

| Interest rate | 11% to 12% |

| Maximum project cost | ₹ 25 Lakh for manufacturing sectors ₹ 10 Lakh for service sectors |

| Subsidy | 15% to 35 % |

| Education qualification | Applicant must be at least 8th standard pass |

| Website | https://www.kviconline.gov.in |

In 2008, the government of India introduced a new credit linked subsidy programme for entrepreneurs known as the Prime Minister’s Employment Generation Programme (PMEGP).

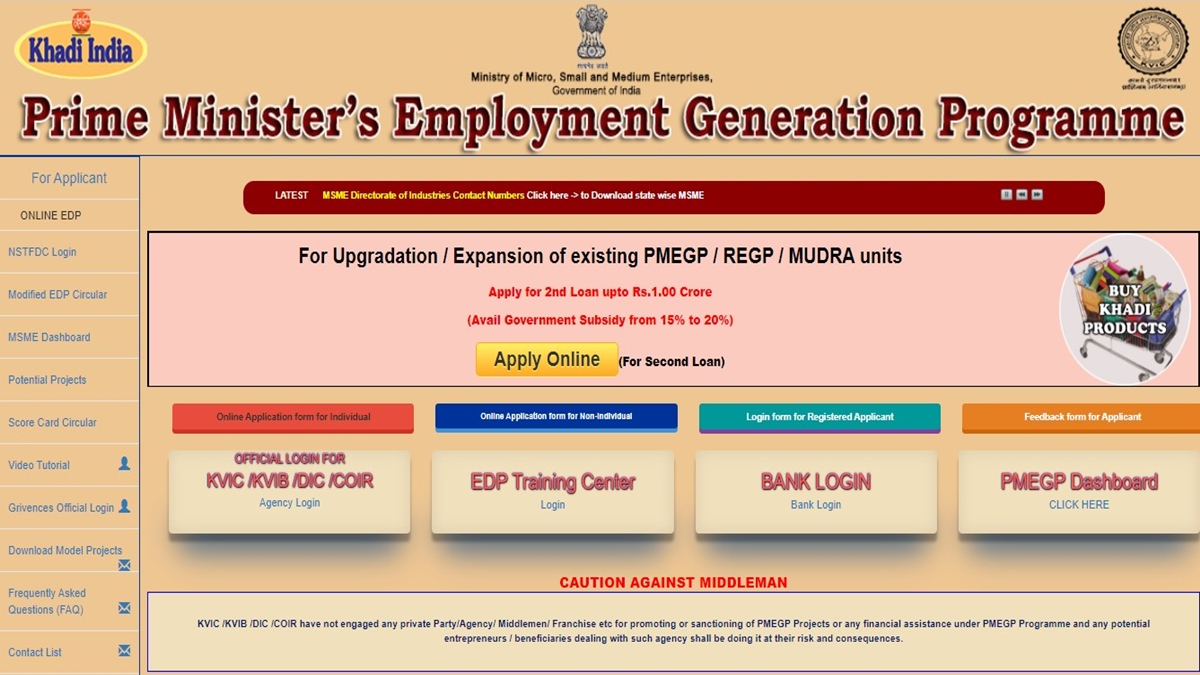

The programme is implemented by the Khadi and Village Industries Commission (KVIC) at a central level and by State Khadi and Village Industries Boards (KVIBs), State KVIC Directorates and District Industries Centers (DICs) and banks at the state level.

The PMEGP scheme was designed to generate sustainable employment opportunities in rural and urban India and facilitate the participation of financial institutions in helping credit flow towards the micro sector. It’s open to individuals as well as certain groups and institutions

With digitization, the PMEGP scheme has also been brought online. Today, not only can you apply for a loan under the scheme online, you can also track it online and even complete EDP training online.

You May Want To Read

| Categories | Beneficiary’s Share | Subsidy Rate – Urban | Subsidy Rate – Rural |

| General | 10% | 15% | 25% |

| Special | 5% | 25% | 35% |

Below mentioned are some of the banks offering loans under the PMEGP scheme:

| Axis Bank | IDFC First Bank |

| Bank of Baroda | Indian Bank |

| Bank of India | Kotak Mahindra Bank |

| Canara Bank | Punjab National Bank |

| Central Bank of India | State Bank of India |

| HDFC Bank Ltd. | UCO Bank |

| ICICI Bank Ltd. | Union Bank of India |

Find below answers to some of the most frequently asked questions about the PMEGP scheme.

The PMEGP scheme is the Prime Minister Employment Generation Program. This is a credit-linked subsidy program that merged the PMRY (Prime Minister’s Rojgar Yojana) and REGP (Rural Employment Generation Program).

It is administered and implemented by the Ministry of Micro, Small and Medium Enterprises, and the Khadi & Village Industries Commission (KVIC).

PMEGP schemes are directed towards generating employment opportunities in urban and rural areas, uplifting traditional artisans, creating self-employment opportunities and increasing the wage-earning capacity of artisans.

The scheme applies to all projects in the rural and urban areas with the maximum project cost for businesses in the business/service sector being ₹ 10 lakhs and ₹ 25 lakhs for the manufacturing sector. Beneficiaries contribute 5-10% of the project cost while the remaining can be taken as a loan. Only 1 person per family is eligible for financial assistance under the PMEGP yojana.

The PMEGP full form is Prime Minister Employment Generation Programme

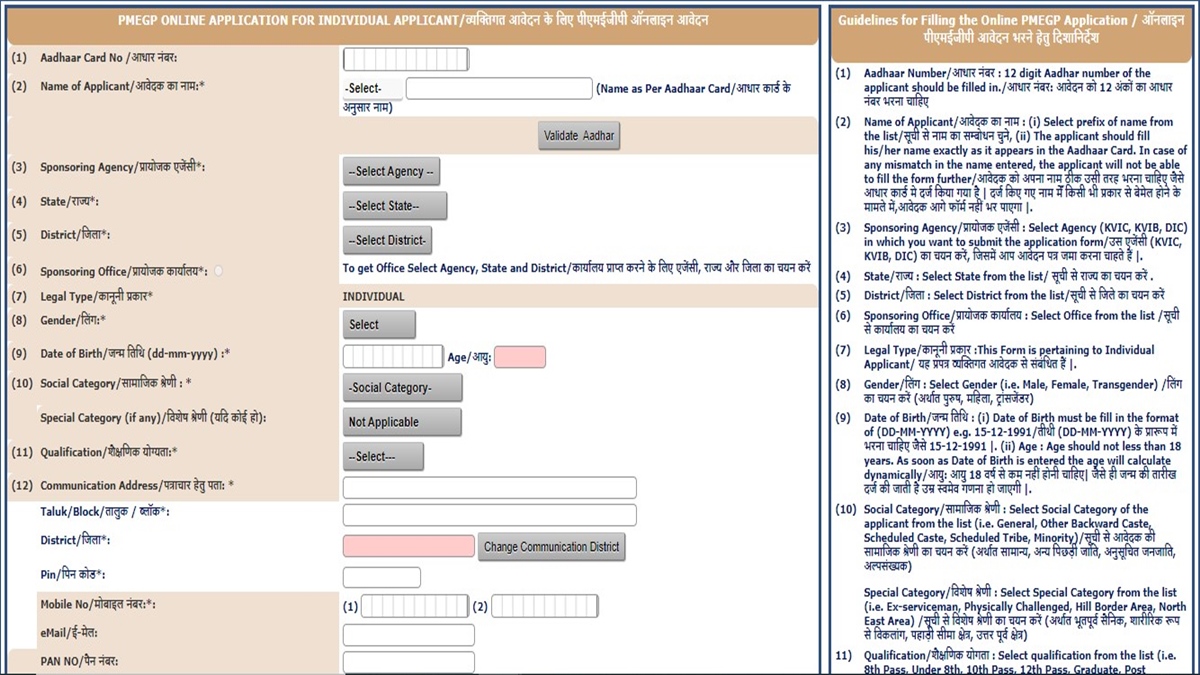

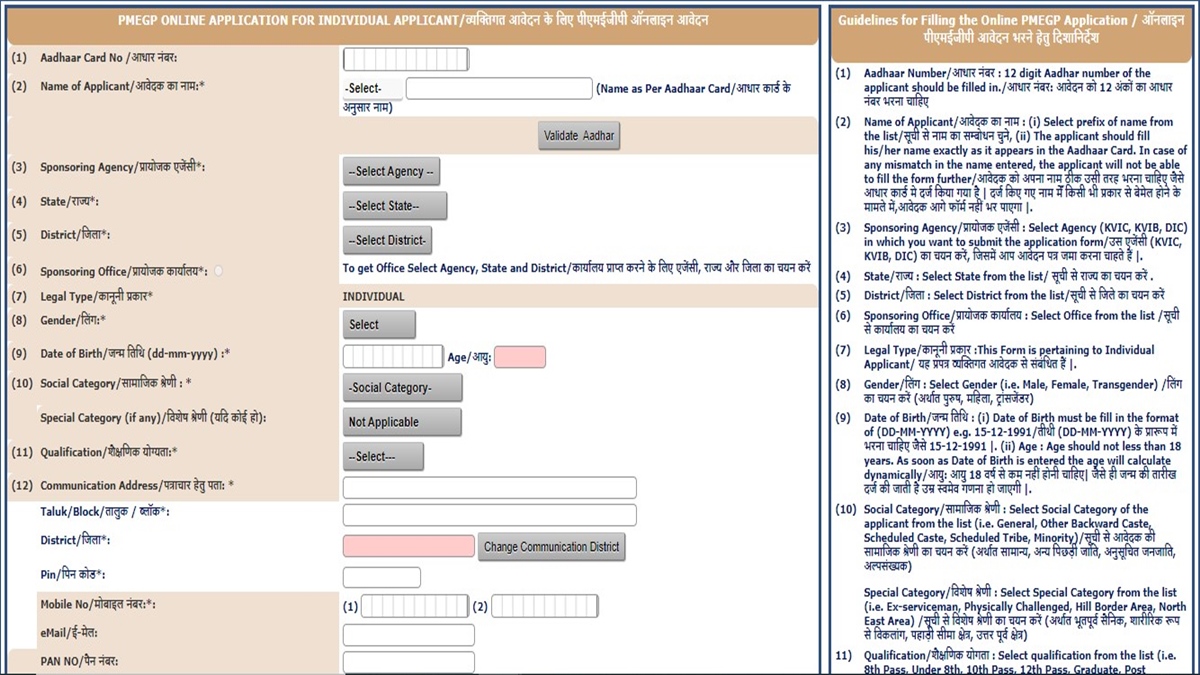

The PMEGP online application form is available on the official portal. To apply online follow the below steps:

Step 1: Click on the tab for Online Application form for Individual or Online Application form for Non-Individual.

Step 2: Enter the details required such as Aadhaar number, name, DOB, gender, address, Bank details, qualification, loan amount, and other such details. Details such as a sponsoring Agency, State, District, Social Category, etc. can be selected from drop-down menus.

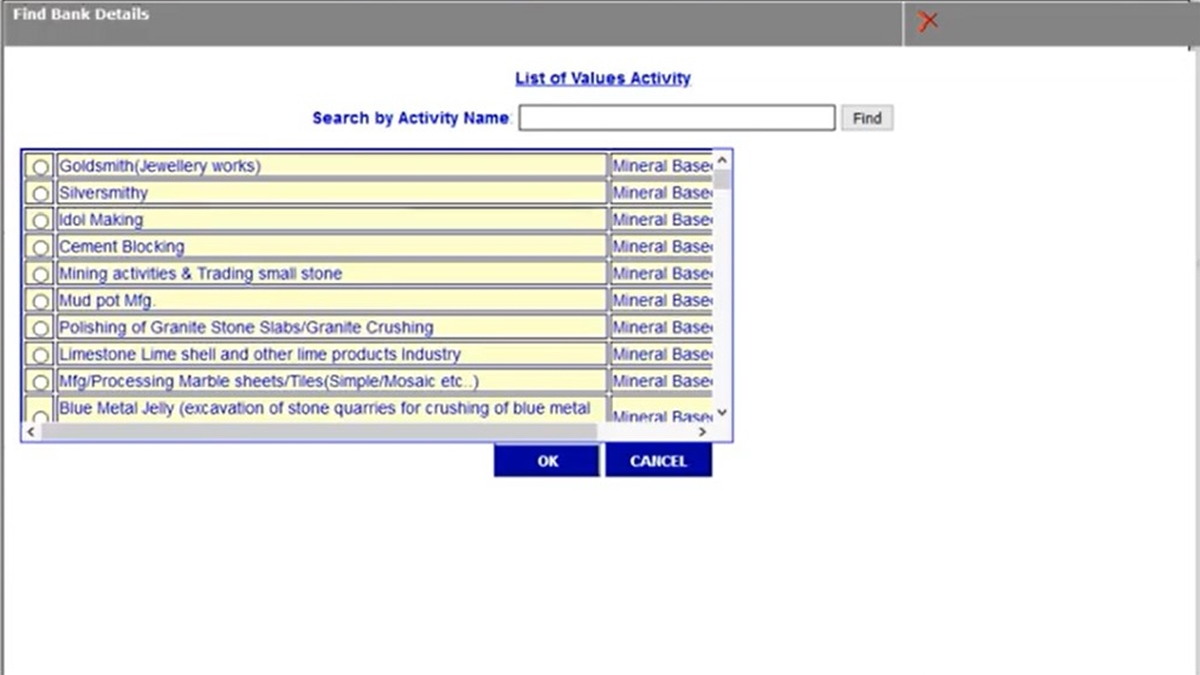

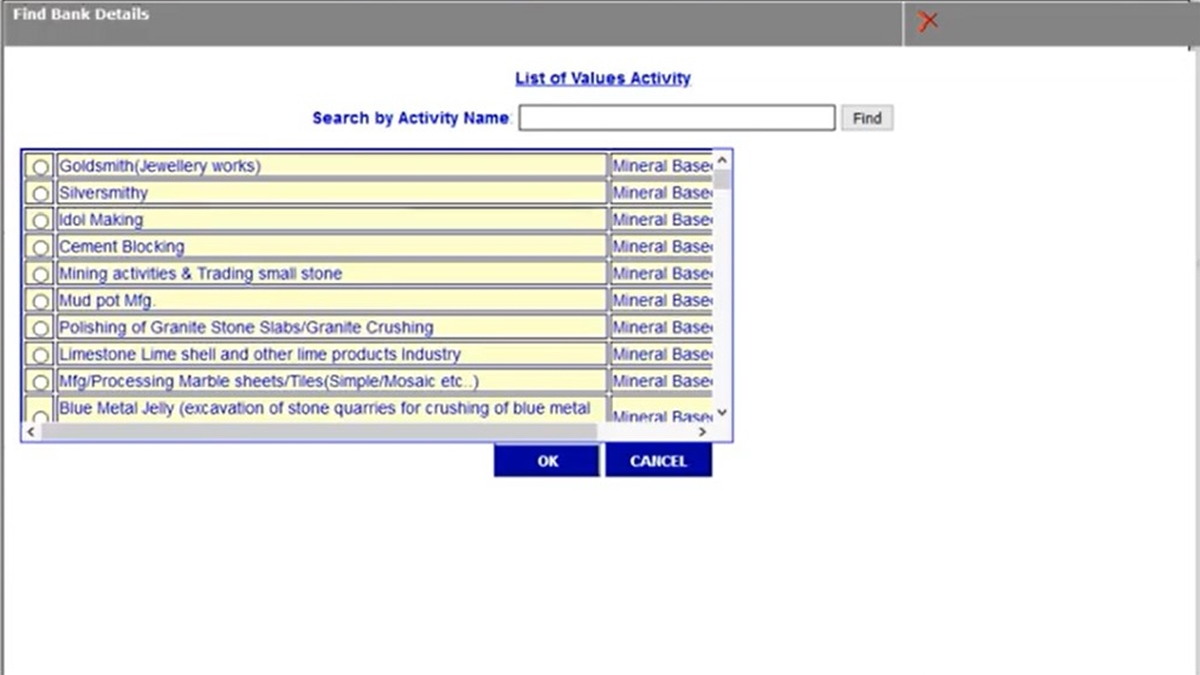

Step 3: When you get to point 15, select the appropriate choice from the drop-down menu under the Type of Activity. A pop-up window will show a long list of Activity names. Scroll down to find the correct activity.

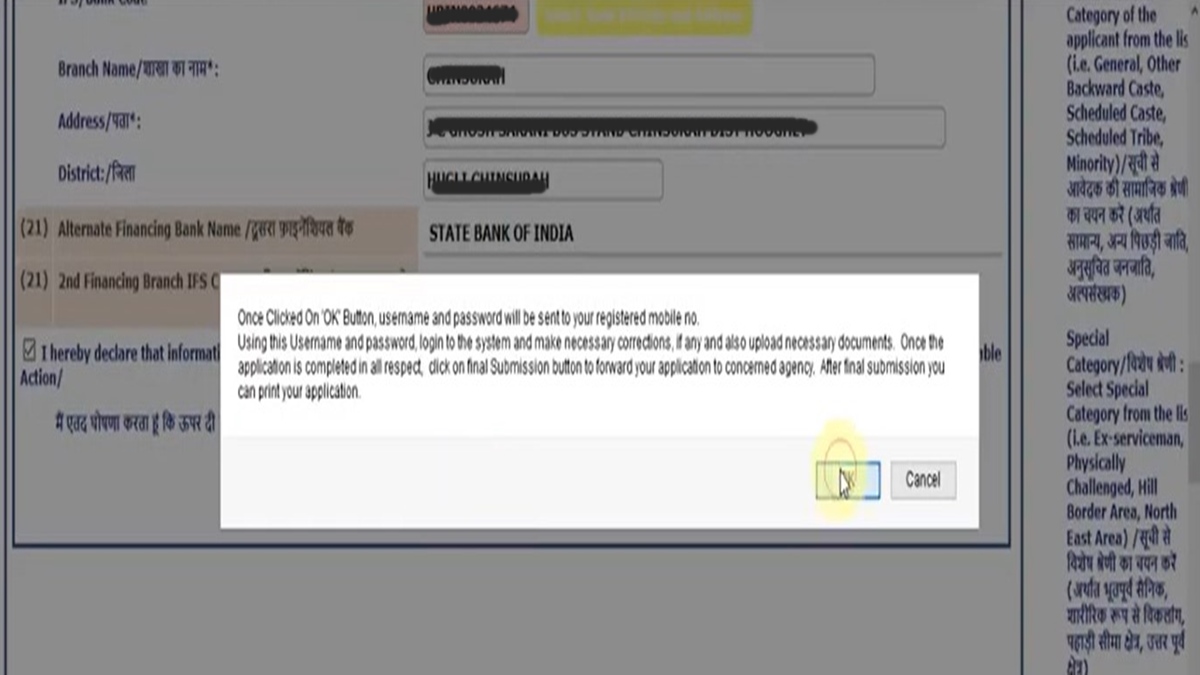

Step 4: Click on the Save Applicant data button. Click on the OK button on the pop-up window to confirm submission.

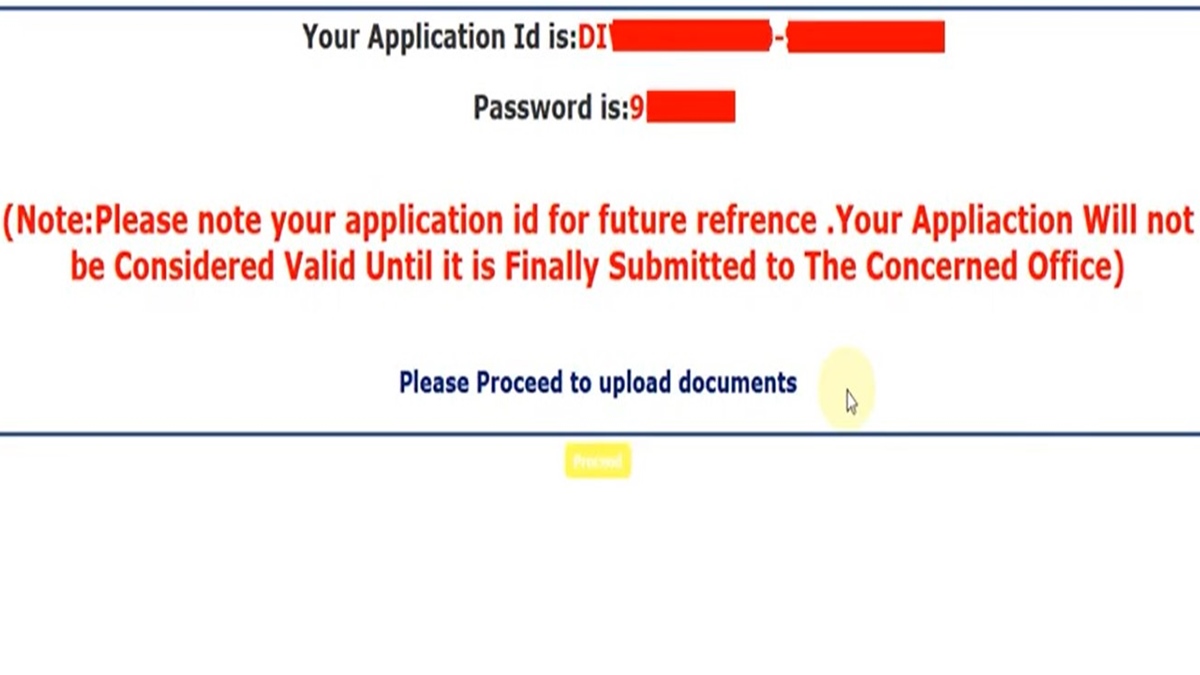

Step 5: You will see an Application ID and Password from PMEGP online on the next page. Save these details for future reference.

Step 6: Upload the supporting documents

You can apply for a PMEGP loan online on the official portal.

Step 1: Click on Online Application form for Individual or Online Application form for Non-Individual as applicable.

Step 2: Enter your 12-digit Aadhaar number, name as it appears on the Aadhaar card. Select the sponsoring agency, state, district, sponsoring office and gender from the drop-down menus.

Enter your Date of Birth in the DD/MM/YYYY format. Select your social category and special category if any is applicable. Select your qualification. Enter your complete communication address, select your unit location and enter the proposed unit address.

Insert PMEGP1.jpg

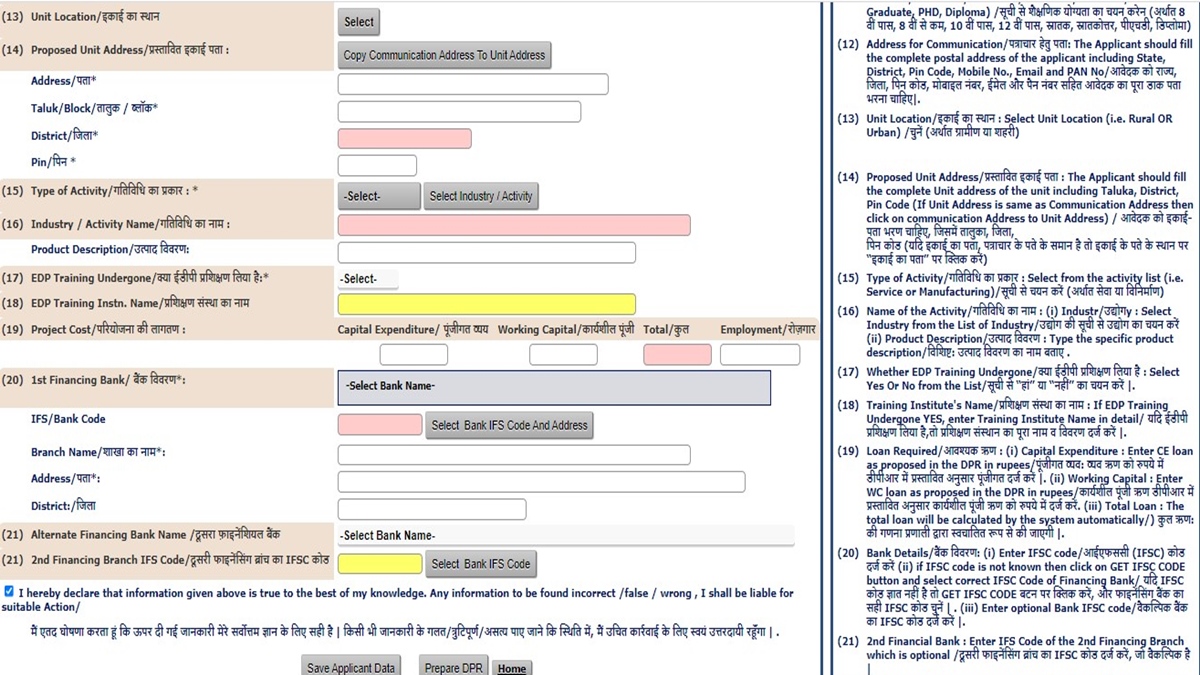

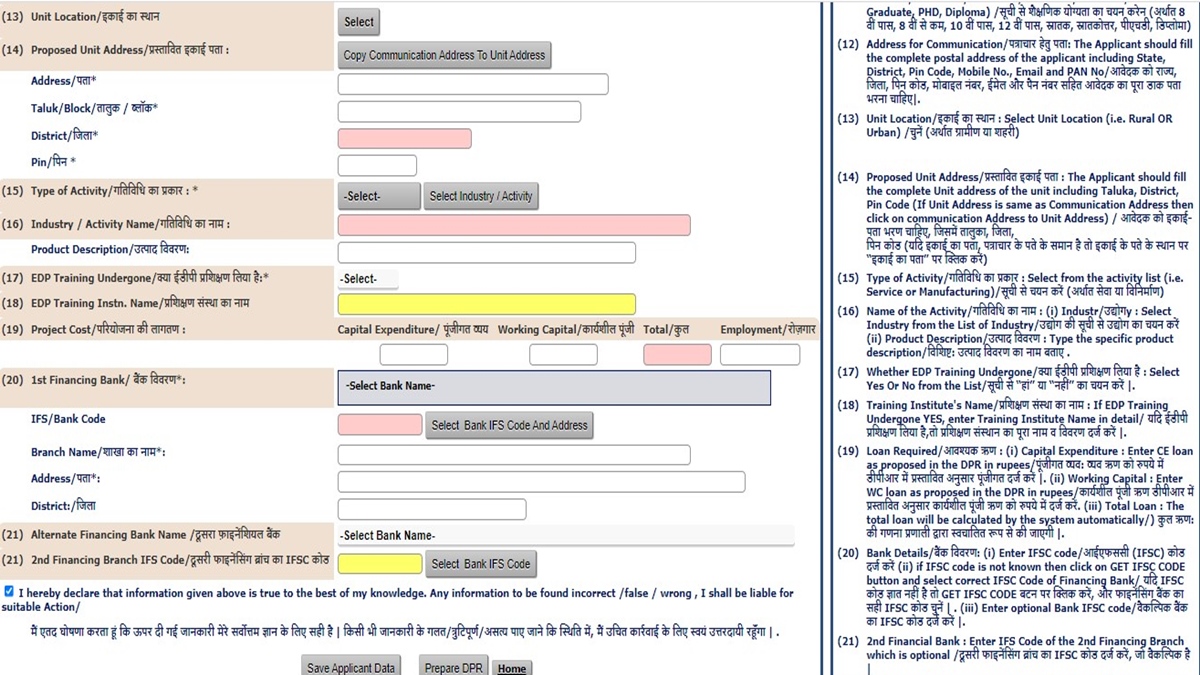

Step 3: Select the type of activity and then the industry/ activity. Enter your industry name.

Step 4: Select whether you have or have not undergone EDP training. If you have undergone training, enter the institution name.

Step 5: Enter the project costs and details of the Financing bank as well as the alternate financing bank name and its IFSC number.

Step 6: Accept the terms and click on the Save Application Data icon. Confirm submission on the pop-up window.

Step 7: You will get an Application ID and Password required for PMEGP bank login in the future.

Step 8: Upload the supporting documents

The documents required when applying for a Prime Minister Employment Generation Program loan are:

1. Aadhaar card

2. Pan card

3. Authorization letter

4. Caste certificate

5. Project report

6. Education/ EDP certificate/ skill development training certificate

7. Rural area certificate

8. Special category certificate – if required

The eligibility criteria for PMEGP loan are:

1. The individual must be at least 18 years old

2. The beneficiary must hold a class VIII pass qualification to be eligible for projects worth at least ₹ 5 lakhs in the business/service sector or ₹ 10 lakh in the manufacturing sector.

3. Assistance is available only for new projects sanctioned under the PMEGP.

4. Self Help groups are eligible for the scheme if they have not availed of benefits under any other scheme

5. Charitable groups, Production Co-operative Societies and organizations registered under Societies Registration Act, 1860 are also eligible for the Prime Minister Employment Generation Programme Loan.

Any unit that is already listed as a beneficiary under a central or state government scheme is ineligible for a PMEGP loan.

Once you have submitted your application, you should keep track of the application status. Prime Minister Employment Generation Programme tracking is available on the website. The steps for e tracking PMEGP application are:

Step 1: Visit the official portal.

Step 2: Click on the ‘Login form for Registered Applicant’ button

Step 3: You will see the login form on a new page. Enter the User ID and Password and click on the Login button.

Step 4: Click on the ‘View Status’ button

The system will generate a PMEGP e tracking report in a few seconds.

PMEGP subsidy from KVIC is dependent on the area where the project is based and the beneficiary’s category.

1. A general category beneficiary or institution must contribute 10% of the cost and can avail of

bank financing for 90% of the project costs.

2. Project in rural areas can avail of a 25% subsidy from KVIC while those in urban areas are

eligible for a 15% subsidy.

3. In the case of special category beneficiaries/ institutions, the minimum own contribution is

5% and the remaining 95% is available as bank financing.

4. Rural area projects are eligible for 35% subsidy while urban area projects are eligible for V

Once the PMEGP loan application is approved, the bank allocates the capital required. This includes the government subsidy.

The PMEGP subsidy is maintained as a savings account linked to the applicant’s loan account. It is locked in for 3 years and then adjusted with the PMEGP loan.

The PMEGP portal is linked to the KVIC website. Click here to visit the PMEGP eportal.

Businesses in a number of industries are eligible for the PMEGP loan scheme list. You can get a fair idea of the PMEGP scheme list here.

Certain other types of businesses are not eligible for PMEGP project loans. Common PMEGP project exclusions are:

1. Business manufacturing/ dealing with crop cultivation, intoxicant items, canned meat, and

polythene bags of less than 20 microns

2. Businesses manufacturing/ producing/ selling cigarettes, cigars, beedis, etc.

3. Rubber, tea, coffee and other such plantations

4. Restaurants/ cafes serving alcohol

5. Industry/ business associated with tobacco and toddy

6. Sericulture

7. Horticulture

8. Floriculture

The PMEGP loan interest rate varies from bank to bank between 11 and 12% per annum.

PMEGP training is now available online. This is free training that all applicants with approved bank loans are eligible for. While the training is not mandatory while applying for a loan, money will not be disbursed until the applicant completes the training. The course must be completed in 15 days.

Step 1: Visit www.udyami.org.in or download the Udyami app here

Step 2: Register with your mobile number as listed in the application

Step 3: Complete the 11 modules

Step 4: Get your certificate and letter of application on completing the course.

For any clarifications, you can call either of these PMEGP helpline numbers:

0752 6000 333 and 0752 6000 555